SHANGHAI, July 22 (Xinhua) -- Guo Junjiang held his breath while watching the live broadcast of an initial public offering (IPO) ceremony Monday morning.

A veteran stock investor, the 34-year-old was expecting an unprecedented chance to share fat dividends by investing in China's emerging innovative firms with huge growth potential.

Bang! With a knock on the opening gong and the anticipation of excited investors like Guo, the new board was finally up on the stage of China's capital market.

The sci-tech innovation board (STAR), China's latest Nasdaq-style high-tech board, started trading on the Shanghai Stock Exchange (SSE) at 9:30 a.m. Monday, kicking off a trail-blazing leg of the country's innovation drive and capital market reform.

The debut of the first batch of 25 listed firms was impressive: As of Monday's closing, they gained about 140 percent on average, with one of them surging more than 400 percent.

Guests attend the debut ceremony of China's sci-tech innovation board (STAR market) at the Shanghai Stock Exchange in Shanghai, east China. China's sci-tech innovation board (STAR market) started trading on the Shanghai Stock Exchange Monday morning, with the first batch of 25 companies debuting on the board. (Xinhua/Fang Zhe)

A BOLD STEP

The new board is China's latest reform attempt to turn the A-share market into a more market-oriented and law-based one.

Unlike other domestic boards, it cuts listing application red tape, allows more market-based pricing, prioritizes information disclosure and tightens delisting rules by piloting the registration-based IPO system, a popular practice in many developed markets.

Trading rules are also different, with no price change limits in the first five trading days. In the following trading days, the board allows stocks to rise or fall by a maximum of 20 percent, higher than the 10-percent limit for most stocks on other boards.

First proposed in November 2018, it took only about 260 days to turn the new board from an idea into reality.

Yi Huiman, chairman of the China Securities Regulatory Commission, addresses the launching ceremony of the sci-tech innovation board of the Shanghai Stock Exchange at the Lujiazui Forum in Shanghai, east China, June 13, 2019. (Xinhua/Fang Zhe)

"It's not just a new board introduced," said Yi Huiman, head of the China Securities Regulatory Commission (CSRC). "The more important thing is market-oriented and law-based system innovation in links including listing and trading and the development of an IPO system centering on information disclosure."

"It will act as an experiment field, from which the experiences can be replicated and shared," Yi said.

INNOVATION FUEL

The establishment of the STAR market aims to fully unleash China's science and technology innovation potential, contributing to enhancing the country's innovation capabilities, said CSRC vice chairman Fang Xinghai.

In the past years, many Chinese high-tech companies went overseas to get listed partly due to less inclusive and flexible capital market rules on the Chinese mainland, while the new board is expected to help nurture high-tech innovative market players to lead China's high-quality growth, according to SSE deputy general manager Que Bo.

A robot is seen making a drink at Changyang Campus in Yangpu district, east China's Shanghai, June 21, 2019. In recent years, Yangpu District has vigorously developed Artificial Intelligence (AI) industry in the process of industrial transformation, making efforts to establish several innovation zones focusing on AI such as Changyang Campus. (Xinhua/Ren Pengfei)

The new board focuses on companies in high-tech and strategically emerging sectors such as next-generation IT, advanced equipment, new materials, new energy, energy saving and environmental protection and bio-medicine.

With lower listing qualification requirements for revenue and profitability, the new board has high standards on research and development (R&D) investment. The R&D investment level of the first batch of 25 companies is generally much higher than that of firms listed on other domestic boards serving growth firms.

The R&D spending of Shenzhen-based small molecule innovative medicines firm Chipscreen Biosciences, one of the 25 firms listed Monday, exceeded 50 percent of its revenue in the past three years.

SHARED DIVIDENDS

While offering more financing channels for domestic innovative firms, the new board also creates fresh business opportunities for financial service providers including sponsors and auditing firms at home and abroad, as well as investment choices for qualified investors.

Mark Leung, J.P. Morgan China CEO, said the company is "encouraged by China's commitment and concrete actions to further strengthen its financial markets."

Following the regulatory approval earlier this year, the company is working closely with relevant authorities in setting up a majority owned and controlled securities company in China, Leung said.

Individual investors who have a stock account balance of no less than 500,000 yuan (about 72,600 U.S. dollars) and more than 24 months' experience of securities trading are qualified to buy STAR stocks. Overseas investors can have access to the new board via the qualified foreign institutional investors system.

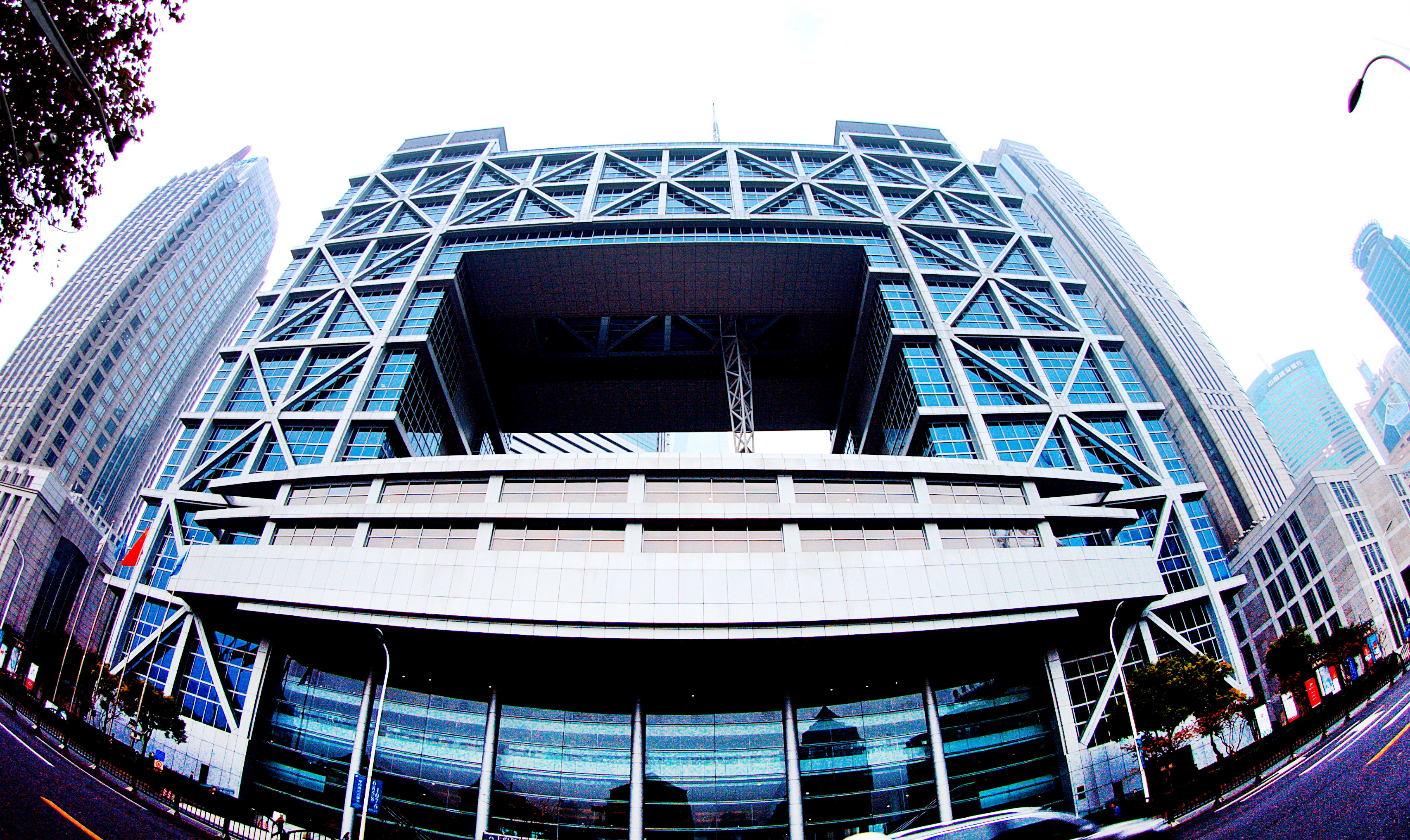

File photo provided by the Shanghai Stock Exchange (SSE) shows an outside view of the SSE in Shanghai, east China. (Xinhua)

The CSRC has warned of short-term speculation and urged investors to invest rationally and keep a close eye on information disclosure as tech companies face more uncertainties. Some mechanisms have been introduced to avoid wild market fluctuations.

The new board's operation smoothness remains to be seen, according to Fang, adding that the board has a bearing on the improvement of China's innovation capabilities and economic growth in the long run. "We will address any challenges coming our way in this new market."

As a cautious investor, Guo chose to wait and see. "It might take time to see any investment pay off, but it's surely worth a shot."

(Video reporters: Ding Ting, Cen Zhilian, Chenjie, Sunqing; Video editor: Zhang Xinyi)