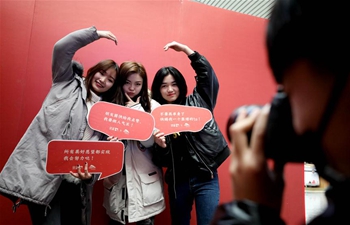

Photo taken on Jan. 28, 2019 shows the launching ceremony for natural rubber options at the Shanghai Futures Exchange in east China's Shanghai. China on Monday launched options for natural rubber, cotton and corn, adding to the tools available to hedge price risks in the world's major commodity market. (Xinhua/Fang Zhe)

BEIJING, Jan. 28 (Xinhua) -- China on Monday launched options for natural rubber, cotton and corn, adding to the tools available to hedge price risks in the world's major commodity market.

Approved by the China Securities Regulatory Commission (CSRC) early this month, the new options trading on the Shanghai Futures Exchange, Zhengzhou Commodity Exchange and Dalian Commodity Exchange, respectively, doubled the number of options listed on the country's three commodity exchanges.

The options for natural rubber included eight trading contracts, those for cotton included four contracts while corn options had five contracts.

Options give a holder the right to buy or sell a commodity at a particular strike price and allow greater hedging flexibility for commercial hedgers such as processors and traders.

CSRC spokesperson Gao Li said spot commodity prices of natural rubber, cotton and corn had seen frequent fluctuations in recent years, and the trading of related options would help companies better manage risks.

It will also help reduce insurance costs for farmers and better serve the vitalization of rural areas, Gao said.

Launching these options will expand the scope of option products and enrich derivative tools that can serve the real economy, said Luo Xufeng, general manager of Nanhua Futures.

REVOLUTION IN THE TEXTILE INDUSTRY

Cotton futures, listed on Zhengzhou Commodity Exchange in June 2004, have become one of the most sophisticated products in China's futures market with a daily trading volume of 138,000 shares.

The 15 years since the listing of cotton futures have witnessed the upgrading of China's cotton pricing and risk management, said Chen Huaping, councilor of Zhengzhou Commodity Exchange.

Research shows that China has seen fluctuations in cotton prices over the years because of more influences in the pricing section. Textile companies thus have growing expectations for cotton options to accommodate more diversified demands for risk management.

"Cotton options, along with other financial tools including cotton futures and insurance, will contribute to the reform of the target price," said Luo Hongsheng, director of CSRC's futures department.

Luo said cotton options would offer more support and protection for agricultural development and speed up shaping of the policy on agricultural subsidies.

With cotton options and futures, relevant OTC derivative products and PTA (purified terephthalic acid) futures in place, the Zhengzhou Exchange has become an international trading center of textile products and derivatives, said Chen.

MORE SAY IN RUBBER PRICING

Natural rubber is considered a vital industrial raw material as well as a strategic material, and its pricing policies are mostly framed in Asia Pacific regions including Tokyo, Singapore and Shanghai.

Shanghai, albeit its large trading volume, has less global influence on pricing compared with the other two markets, said Cai Luoyi, an expert in the futures market.

Cai said most futures contracts listed in Shanghai only met the domestic standards, and China's rubber futures trading was yet to be opened up to the rest of the world.

In recent years, China's rubber planting has taken advantage of natural rubber futures to secure profits, enhance risk management and facilitate business operation, said Zheng Wenrong, vice president of China Natural Rubber Association.

Shanghai's natural rubber futures have become the world's largest in terms of transaction volume, said Jiang Yan, councilor of the Shanghai Futures Exchange.

Options for natural rubber will better serve companies in the relevant industrial chain and the real economy, Zheng added.

Meanwhile, Shanghai is busy preparing for the listing of TSR20 futures, a major rubber species for worldwide production use. TSR20 futures will be open to foreign traders.

As more participants join in, Shanghai's natural rubber price will have more influence on global pricing, said Ma Wensheng, president of Xinhu Futures.