Photo taken on May 27, 2019 shows the site of the first session of the UN-Habitat Assembly in Nairobi, Kenya. The first session of the UN-Habitat Assembly opened Monday in the Kenyan capital Nairobi as participants gather to discuss ways of improving quality of life in cities and communities amid the rapid global urbanization. (Xinhua/Lyu Shuai)

NAIROBI, May 29 (Xinhua) -- Financial policymakers and experts drawn from institutions and enterprises in China and Africa met in Nairobi on Tuesday to discuss how to accelerate investment and collaboration for financial inclusion in Africa.

At the "2019 China-Africa Digital Financial Inclusion Summit," which followed a similar event held in Beijing in September 2017, the professionals are discussing how to promote the global development agenda of digital financial inclusion (DFI) by building a collaboration platform between China and Africa to facilitate knowledge sharing, partnerships, and investments.

The event, which touches on DFI innovation and development in Kenya and Africa in general, saw leading Chinese digital financial inclusion organizations displaying cases in DFI in China.

In his opening remarks, Bei Duoguang, president of Chinese Academy of Financial Inclusion (CAFI), which is one of the organizers, said the meeting will build a platform for dialogue, communication and cooperation.

Financial inclusion in countries along the Belt and Road can provide funding to small and medium-sized enterprises and microbusinesses to stimulate economy and improve people's living standards, Bei said.

"By providing financing to individuals, financial inclusion can make people actively involved in economic activities, enhance their sense of involvement and level of happiness," he added.

He said in CAFI's study of financial inclusion in countries along the Belt and Road, the average account ownership for low income countries stands at 35 percent, whereas only 2 percent of population in the same countries has credit cards.

"Thanks to technology innovation, digital financial inclusion tools such as mobile banking are speeding up the pace of middle and low-income countries to catch up with the rest of the world," Bei noted.

During the conference, Chinese policymakers also expect to gain a deeper understanding of the financial inclusion landscape in different African countries to explore business and investment opportunities and serve as an innovative and influential platform to advocate financial services for social development.

Li Dongrong, President of National Internet Finance Association of China, said China and African countries have common aspirations and willingness to develop inclusive finance and promote broad growth.

Li said in 2012, China proposed the concept of promoting the realization of inclusive finance with mobile finance and has actively explored innovative models such as mobile payment, mobile lending, and mobile wealth management.

"African countries have also explored a lot in this field, such as mobile payment and correspondent banking. It is of great realistic significance for experts and scholars from China and Africa to gather here in Africa, exchange perspectives and learn from each other on digital inclusive finance," Li said.

Li said since the World Bank formally proposed the concept of "inclusive finance" in 2005 with the joint efforts of international organizations and different countries, the development of global inclusive finance has achieved great progress, adding that China's inclusive financial development ranked high, with the account ownership rate at 80 percent and digital payment usage standing at 68 percent.

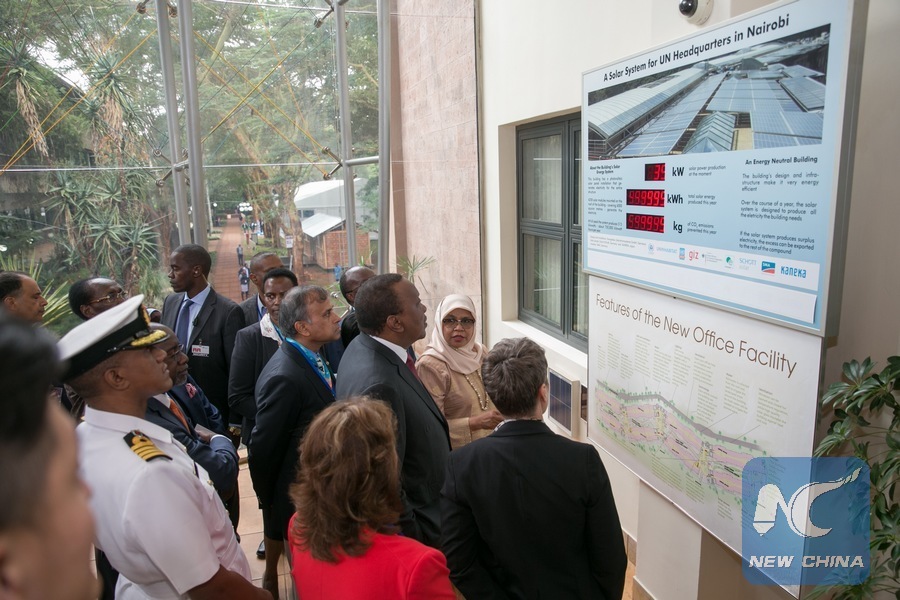

Uhuru Kenyatta (C), Kenyan President looks at a design of a solar system of the new office facility at the United Nations headquarters during the opening ceremony of the first session of the UN-Habitat Assembly in Nairobi, Kenya, May 27, 2019. (Xinhua/Fred Mutune)

Uhuru Kenyatta (C), Kenyan President looks at a design of a solar system of the new office facility at the United Nations headquarters during the opening ceremony of the first session of the UN-Habitat Assembly in Nairobi, Kenya, May 27, 2019. (Xinhua/Fred Mutune)

Zhao Xiyuan, minister counselor at the Chinese Embassy in Kenya, told the experts that the deliberations of the forum will go a long way in coming up with solutions and ways in which China and Africa can collaborate in the field of digital financial inclusion, which is key to development.

China has achieved remarkable development progress in the past decades. Africa, too, has made great advance and during the process of common development, China and Africa have strengthened their relationship dramatically where they enjoy growing mutual trust and exchanges at all levels, Zhao said.

The envoy said in recent years, people with access to formal financial services have increased unprecedentedly owing to the launch and growth of digital financial services in Africa.

The continent is now home to most digital financial services deployments, with about 350 million individual users, Zhao said, adding that mobile money solutions and agent banking now offer transactions, savings, credit, and even insurance opportunities in rural villages and urban neighborhoods, where no bank had ever established a branch.

Gabriel Negatu, Director General of East Africa Regional Development and Business Delivery Office at African Development Bank, said at the forum that continued dialogue and experience sharing between China and Africa will accelerate the progress in DFI. Negatu said mobile revolution helped boost the economic growth in Africa over the past decades, stressing efforts should be made to enhance connectivity and inter-operability of different payment systems in Africa.

The summit brought together more than 200 participants from the digital financial services and fintech industries. It was co-hosted by CAFI, Finance Center for South-South Cooperation and FDS Kenya, and had the support from China Banking Association and the Bill & Melinda Gates Foundation, among others.